salt tax cap new york

Yet while the newly adopted budget encourages high-income taxpayers to take advantage of these provisions they ought to come with a warning. New York is taking another run at repealing SALT cap.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

SALT cap workaround enacted for 2023.

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

. These state-level laws permitted. Why the SALT Deduction. The Supreme Court will not revive an attempt by New York and three other states to overturn the Trump-era 10000 cap on state and local tax deductions known as SALT.

New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap. The SALT cap limits a persons deduction to 10000 for tax years beginning after December 31 2017 and before January 1 2026. The provision was part of Gov.

Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation. With changes to the tax code enacted in the 2017 Tax Cuts and Jobs Act deductions were capped at 10000 starting on January 1 2018.

The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law. The SALT deduction cap adds to the overall cost of property ownership in NYC where property taxes tend to be high when compared to other regions. Enacted by the Tax Cuts and Jobs Act of 2017 the SALT cap spurred legislation in Connecticut New Jersey and New York that allowed residents to bypass the limit.

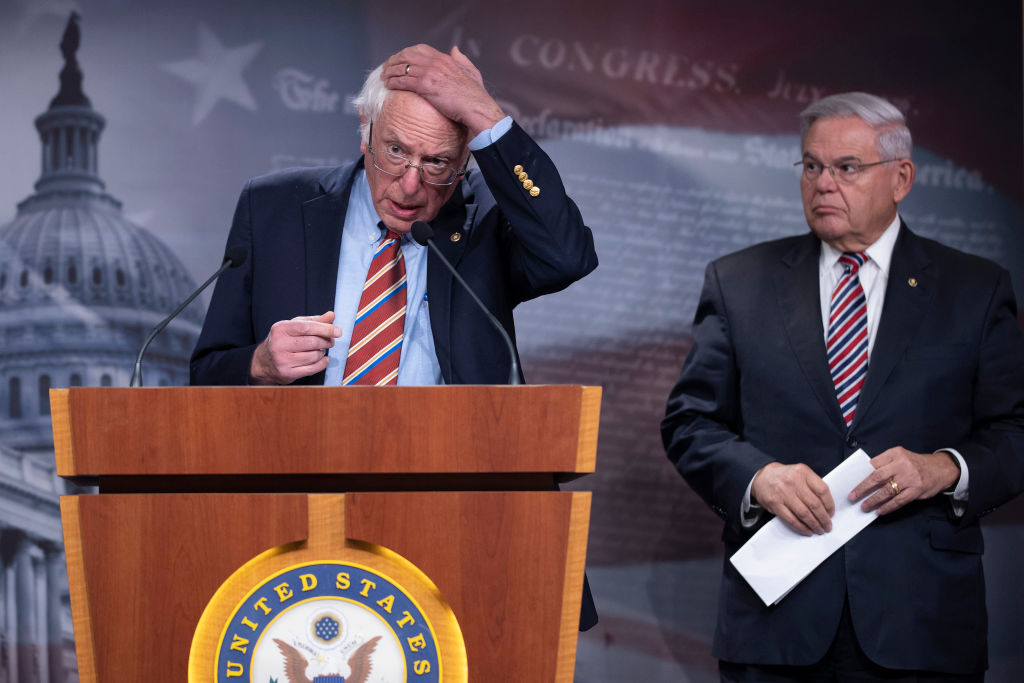

Raising the 10000 SALT cap has been a key priority for Senator Bob Menendez. New York State and NYC real estate taxes for decades. Bernie Sanders D-Vt is vowing to tweak the SALT provision perhaps by lowering the new cap to 40000 andor imposing an income limit of 400000 to benefit from it.

According to WalletHub when you measure taxes on individual. Note that as part of ongoing discussions in Congress around the framework of President Bidens Build Back Better plan some Democrats have proposed increasing the SALT deduction cap from 10000 to 80000. The Pass-Through Entity tax allows an eligible entity to pay New York State tax.

But its not entirely clear when or if that cap put in place as part of the 2017 federal tax. The new tax which is included in Budget Bill A09009C is effective for tax years starting on or after January 1 2023. The SALT cap has been a pain.

The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on a small scale. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

States that benefit most from the SALT deduction include California New York Illinois and Texas. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. New York State 20212022 Budget Act SALT Cap Workaround The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

2 hours agoManchins Wednesday statement also said that he supports a 15 corporate minimum tax for the largest US companies. Many states have recently enacted SALT cap workarounds to protect. Unlike most states New Yorks fiscal year begins early on April 1 so it was motivated to act quickly.

They wont really count when the 10000 cap on state and local tax deductions is repealed by Congress. Biden to include the elimination of the SALT cap as. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. Cuomos initial budget proposal in January and it comes at a time when many Democrats are calling on Pres. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

Supreme Court has rejected a challenge from New York and other states to overturn the 10000 limit on the federal deduction for state and local taxes. Article Posted date 13 April 2022 Download pdf 14 MB. Andrew Cuomos spin on the tax hikes in the state budget approved this month is this.

New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. States and cities with high income taxes also tend to be high-opportunity states like California and New York.

New Yorks plan similar to that of some of the earlier adopters is to basically convert personal SALT such as your New York income taxes which are subject to the 10000 cap into business SALT which is deductible in full as.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Why This Tax Provision Puts Democrats In A Tough Place Time

Don T Miss The Election For The Salt Cap Workaround

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

State And Local Tax Salt Deduction Salt Deduction Taxedu

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows